Family Offices: Steps, Stages and Structures – Private Trust Companies and the Guernsey Private Foundation

There are a variety of structures and arrangements available to Individuals and their families both for estate and succession planning and to protect their assets from uncertainty and volatility.

Modern families are increasingly mobile and it is common for family members to move to new countries to study, work, establish businesses or settle down. As families become more geographically diverse the complexity of administering family estates and assets along with cross border, succession and estate planning matters, increases.

Steps, Stages and Structures

Many families will have complex affairs yet not be of sufficient size to warrant the establishment of a dedicated single-family office. For these families there are various alternatives through which the family may transition.

Pooled and enhanced fiduciary support

The family may consider transferring the administration of their holding entities to a professional licensed fiduciary with whom the family has an existing relationship or who has been recommended by a trusted advisor.

These structures may take the form of a Discretionary Trust or Foundation. The Trustee or Foundation Council can then be tasked with assisting the transition the family’s affairs into a standalone family office position, utilising their knowledge, experience and existing resources of qualified staff and policies and procedures. At this stage efficiencies are created in the management and administration of the structures under a single provider, the family / advisor relationship is reinforced, and additional cost savings often result.

Private Trust Company (PTC)

For many years the PTC has been the preferred vehicle for administering the assets of wealthy families and many variants have emerged across the various financial centres which specialise in providing them and whose legislation and regulation are particularly suited to private wealth management.

One of the main attractions of the PTC being those decisions, relating to the underlying trusts and assets, are made by directors who are carefully chosen by the family or may even be family members.

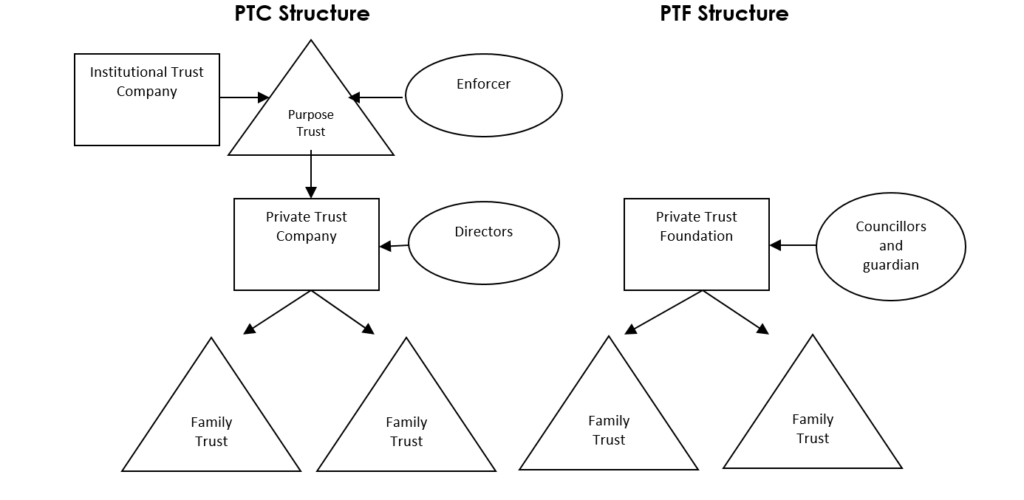

There are a number of variants of the PTC, which can be limited by either shares or guarantee or even with separate classes of shares for voting purposes. Consideration as to the level of control exerted over the PTC needs to be carefully considered as too much control can lead to tax implications. The most common solution to the control issue has been to hold shares in the PTC through a purpose trust (see diagram), which creates additional layers of ownership and administration.

Whilst PTC’s remain a popular specialist solution, Guernsey can also offer a simpler structure through the Private Trust Foundation (PTF).

Private Trust Foundation (PTF)

The PTF removes the need for any ownership layers above the PTC and can simplify the structure and therefore administration and cost (see diagram). The PTF is established under the Foundations (Guernsey) Law 2012 (the “Law”) with the sole purpose of acting as trustee of the trusts for the benefit of an individual or family.

The Law makes it clear that a Guernsey Foundation, upon establishment, has its own legal personality, independent from that of its founder and any foundation officials.

Diagram: The Classic Private Trust Company Structure and Alternative Guernsey Foundation Solution

The Guernsey PTF will be run and managed in a similar way to a PTC with the involvement of a professional licensed fiduciary, but with the significant advantage that, as an orphan vehicle, it does not have any other owners or controllers.

Additionally, family members or other trusted advisors can be appointed to the PTF council, which is responsible for acting as trustee to the underlying family trusts.

Managed Services

The penultimate stage, in the route to establishing a full standalone family office directly employing appropriately experienced staff in the jurisdiction of choice, is managed support from a fiduciary provider.

This support can include dedicated serviced office space such as the Dixcart Business Centre in St Peter Port, Guernsey together with business facilities, fiduciary, accounting and legal support, with a view to the fiduciary provider helping to grow and develop the position into a standalone family office operating independently.

Additional Information

For further information on private wealth structures and their management, please contact John Nelson, Managing Director, Dixcart Trust Corporation Limited, Guernsey: john.nelson@dixcart.com

Dixcart Trust Corporation Limited, Guernsey: Full Fiduciary Licence granted by the Guernsey Financial Services Commission. Guernsey registered company number: 6512.